In almost all cases this is irrelevant because children generally do not earn money.”

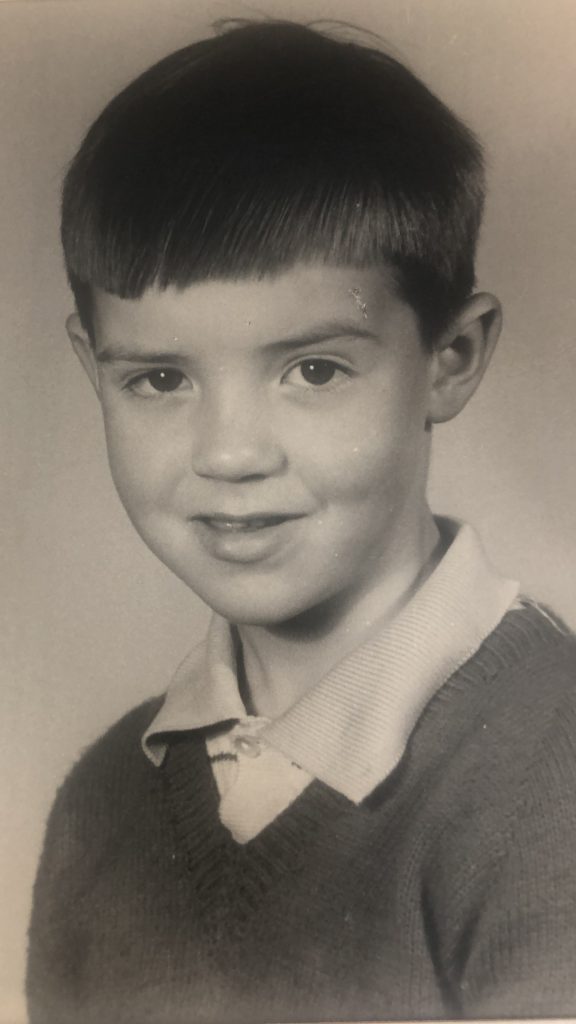

Nigel Holland

Do children pay income tax on their savings? Technically, yes – children are liable to pay tax on savings, as they have the same income tax allowance as adults. It’s uncommon, though, as children generally don’t earn money, and their savings don’t tend to earn enough interest to exceed any tax thresholds.

Like adults, children get a personal tax-free allowance, which is how much income they can earn before paying any tax. This is £12,500 in the 2020-21 tax year, the same as in 2019-20. If this income is from savings interest, there are extra tax-free allowances in addition to the personal allowance, allowing a child to potentially earn up to £18,500 tax-free in the 2020-21 tax year.

The personal savings allowance The personal savings allowance allows you to earn £1,000 in savings interest tax-free if you pay no income tax or the basic-rate of tax. This bumps up the total amount they can earn free of income tax from £12,500 to £13,500 in the 2020-21 tax year. If a child’s income does exceed the personal allowance – which could be the case if they receive money from a trust, for example – you must inform HMRC, and, depending on how much money they receive, tax may be owed.

In addition to this, the savings starter rate is designed to encourage low earners to save, by giving them an extra tax-free allowance on savings interest. If your income is equal to or less than the personal allowance, you can earn up to £5,000 in savings interest tax-free, pushing the total amount they could earn tax-free, inclusive of the personal savings allowance, to £18,500. But for each £1 earned over the personal allowance, the savings starter rate will reduce by £1.