Nigel Holland

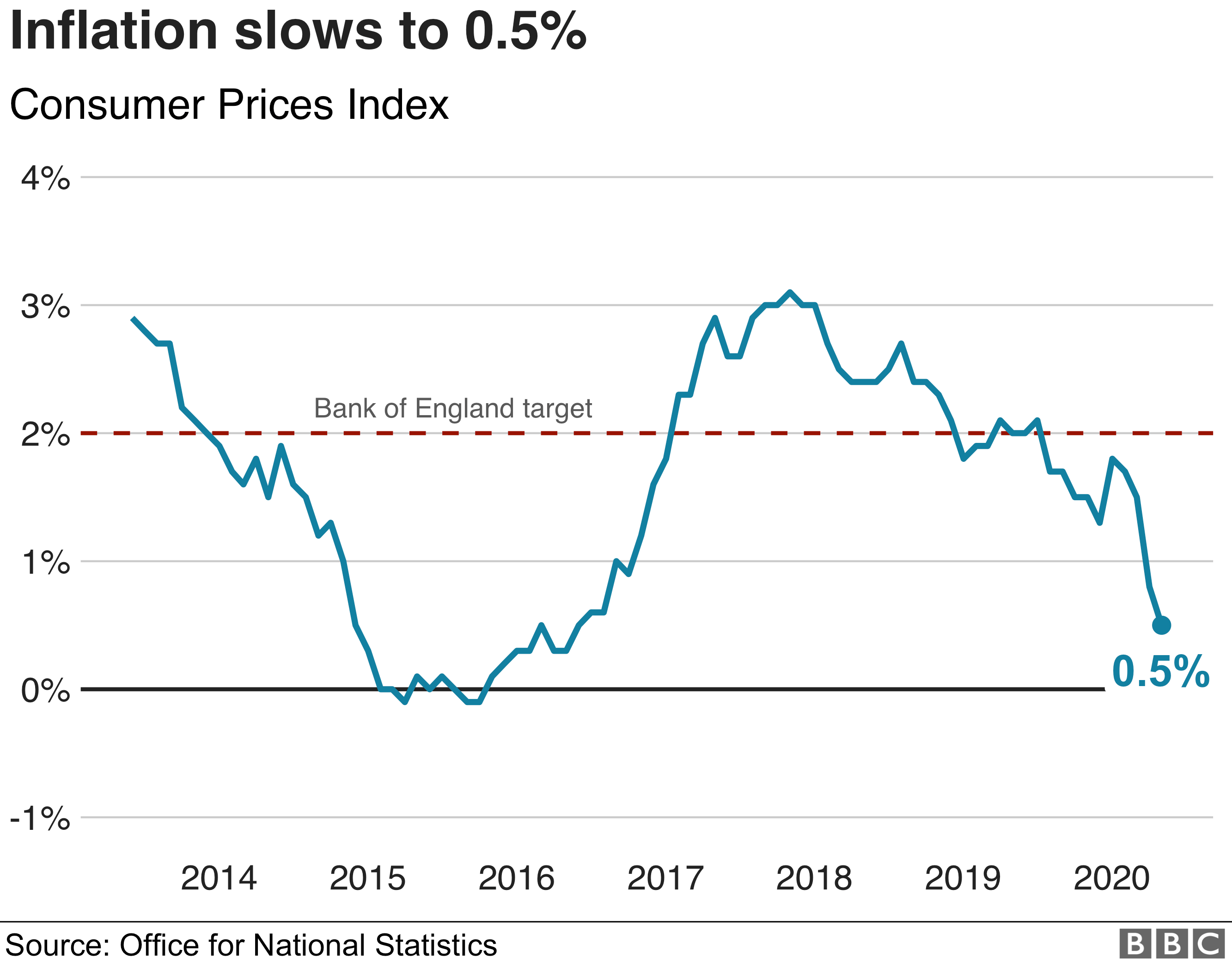

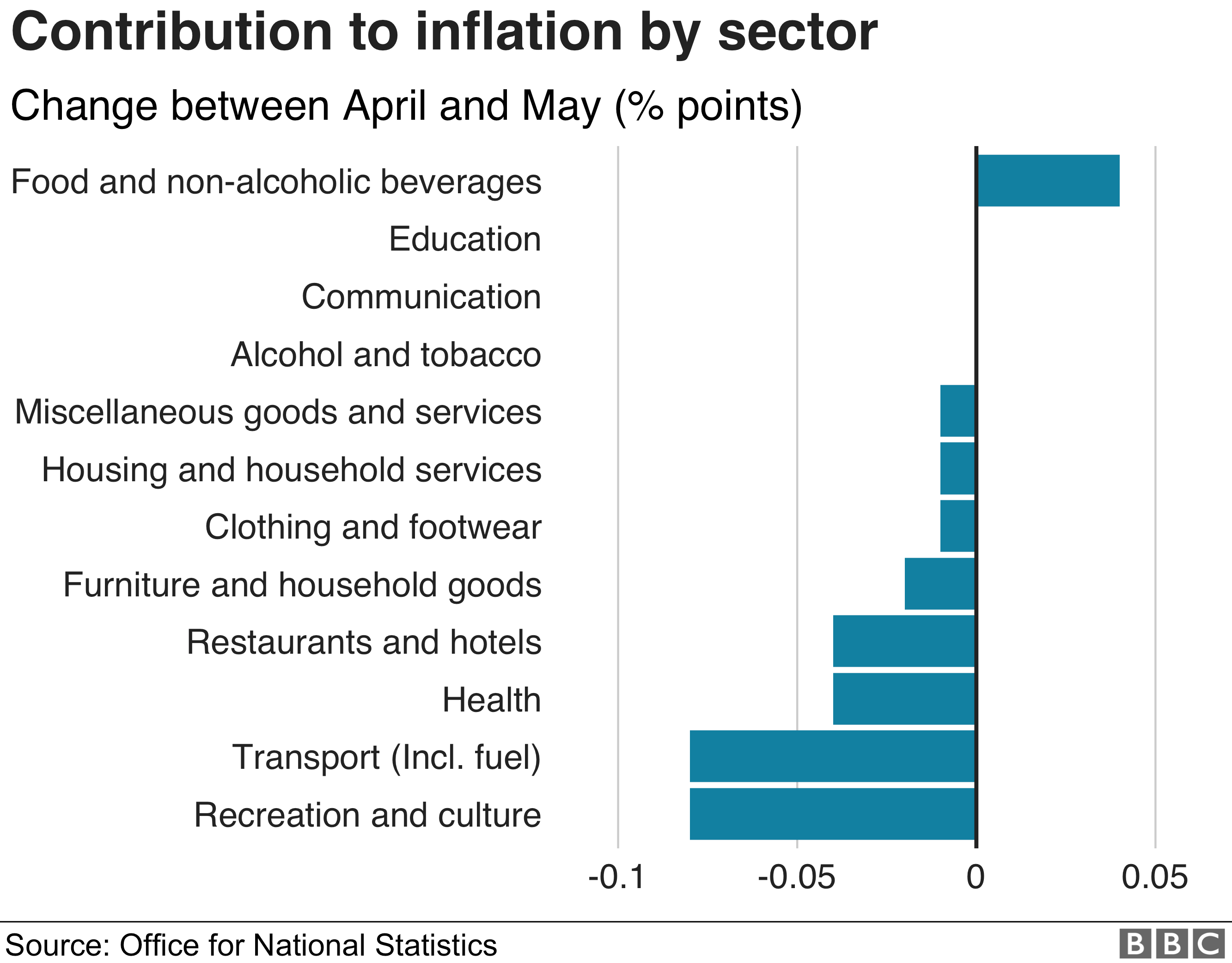

A record fall in fuel prices, including petrol, pushed the UK’s inflation rate down to 0.5% in May, the second full month of the coronavirus lockdown.

Fuel prices declined by 16.7% during the month, the Office for National Statistics (ONS) said, dragging the Consumer Prices Index (CPI) to the lowest level since June 2016.

Clothing and footwear prices also fell.

Supermarkets were among the few shops allowed to open in May and food prices rose, the ONS said.

May’s inflation rate was down from 0.8% in April, the first full month of the pandemic lockdown.

Clothing and footwear prices fell 3.1% amid heavy discounting.

What is inflation?

Inflation is the rate at which the prices for goods and services increase.

It’s one of the key measures of financial wellbeing because it affects what consumers can buy for their money. If there is inflation, money doesn’t go as far.

It’s expressed as a percentage increase or decrease in prices over time. For example, if the inflation rate for the cost of a litre of petrol is 2% a year, motorists need to spend 2% more at the pump than 12 months earlier.

And if wages don’t keep up with inflation, purchasing power and the standard of living falls.

Pump prices

“The growth in consumer prices again slowed to the lowest annual rate in four years,” said ONS deputy national statistician for economic statistics Jonathan Athow.

“The cost of games and toys fell back from last month’s rises, while there was a continued drop in prices at the pump in May, following the huge crude price falls seen in recent months.

“Outside these areas, we are seeing few significant changes to the prices in the shops.”

The ONS admitted that it had difficulty compiling inflation statistics for May, since many areas of the economy were completely shut down.

For instance, inflation figures for holidays had had to be “imputed”, it said.

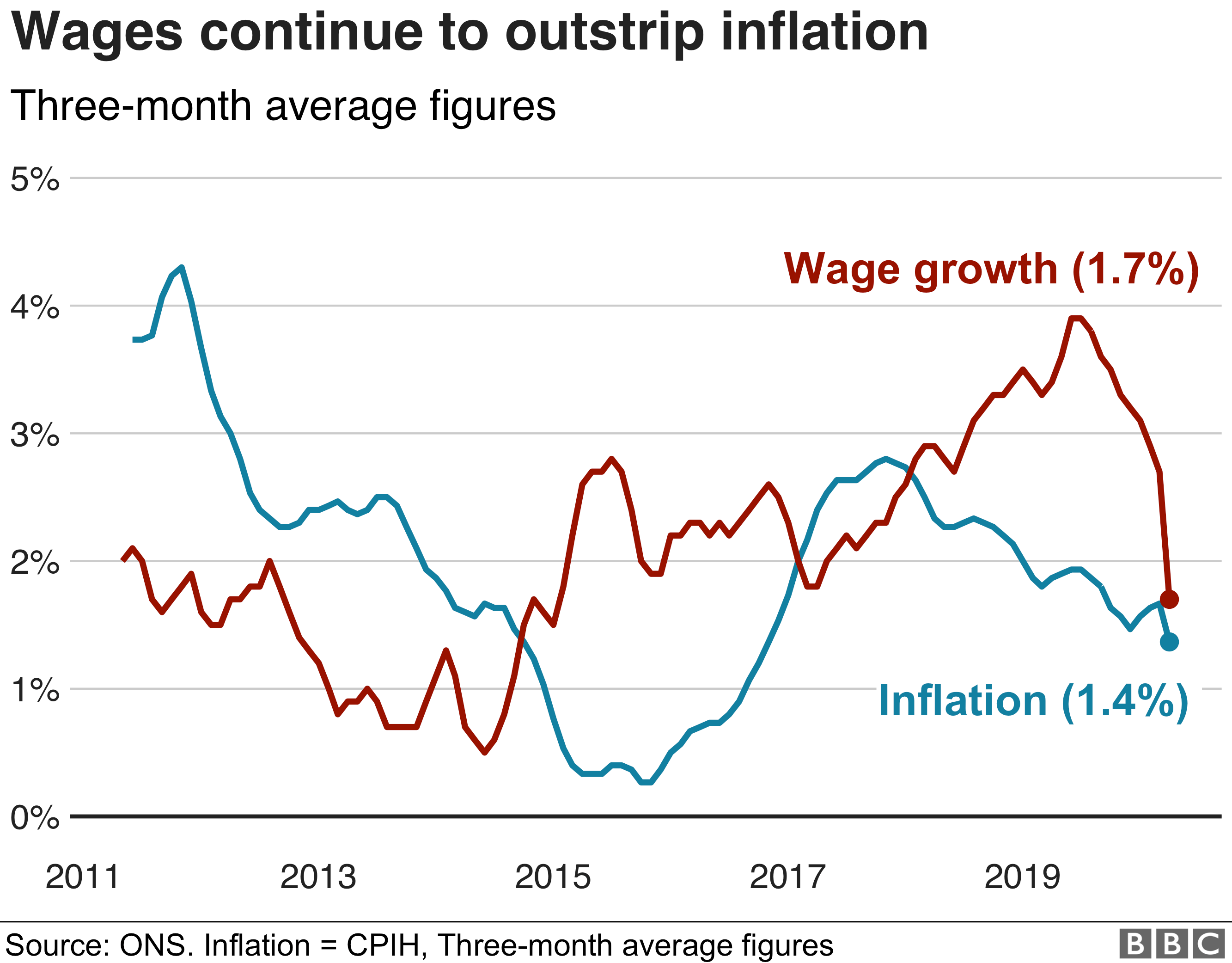

Separate figures issued by the ONS on Tuesday showed that in the three months to April, workers’ regular pay, excluding bonuses, grew at an annual rate of 1.7%, the weakest since January 2015.

However, when measured against the comparable three-monthly inflation rate, that means pay growth is continuing to outstrip inflation.

CPI remains below the Bank of England’s 2% target for inflation.

Inflation is one of the main factors that the Bank of England’s Monetary Policy Committee (MPC) considers when setting the “base rate”. That influences what interest rates banks can charge people to borrow money, or what they pay on their savings.

Interest rates are currently at 0.1%, the lowest level in the Bank’s 325-year history.

“May’s further fall in inflation is probably only the beginnings of a prolonged period of very soft price pressure,” said Paul Dales, chief UK economist at Capital Economics.

He added that MPC members were expected to opt for more stimulus measures to boost the economy at their policy meeting on Thursday.