” We are living in one of the strangest periods in history where the Government introduces a number of tax measures one day and then reverses those same measures a few days later. This results in uncertainty for the markets which is not a good thing.”

Quote from Nigel Holland

Details about the new plan from the Government

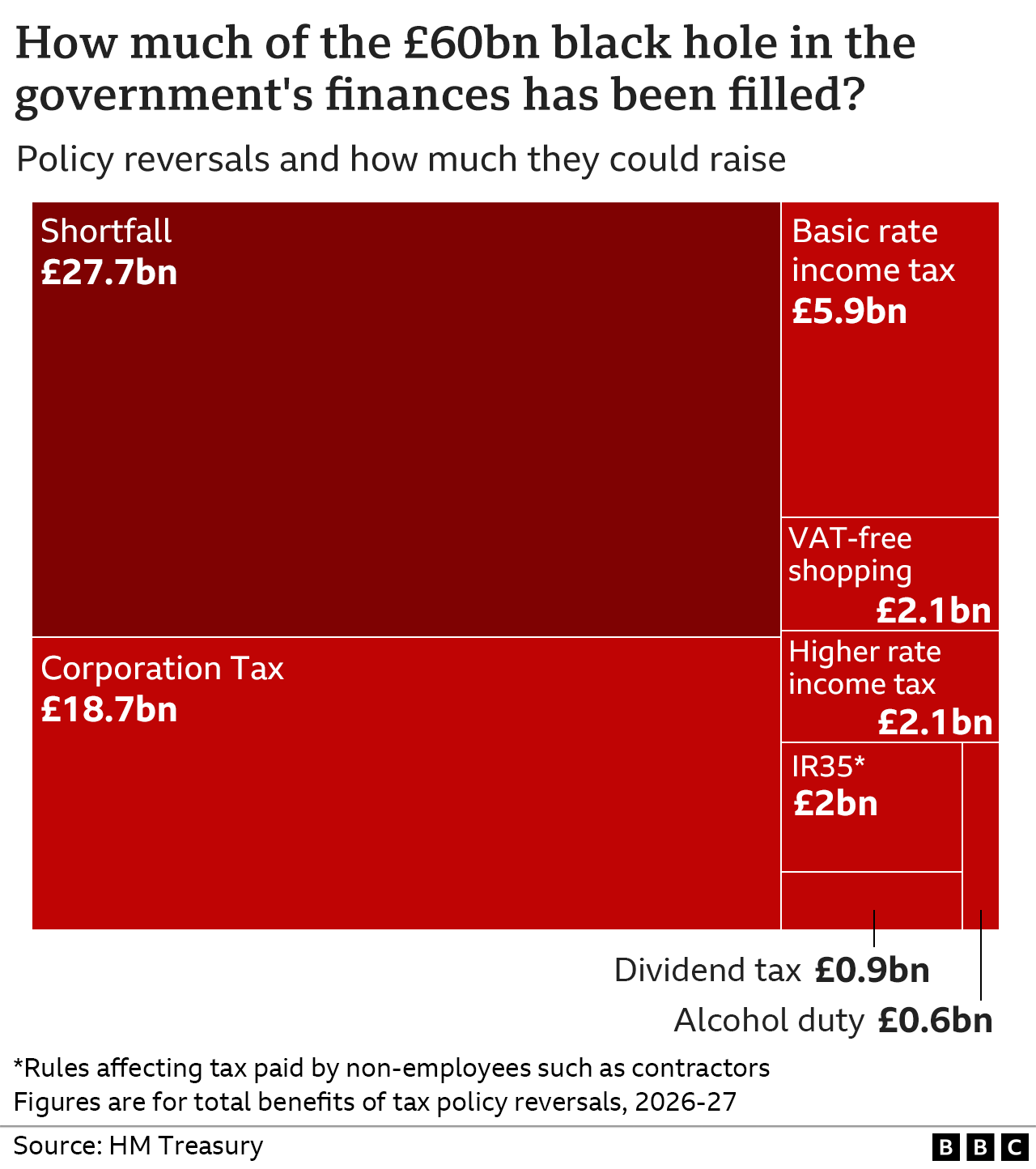

The government will reverse almost all tax measures announced in its mini-budget.

Plans to cut the basic rate of income tax to 19% have been shelved and support for energy bills scaled back.

The mini-budget was only unveiled on 23 September, but caused turmoil on financial markets.

Income tax – basic rate

What was announced:

- The basic rate was to be cut to 19% from April 2023. The government said this would save 31 million people £170 a year

- People in England, Wales and Northern Ireland pay 20% on any annual earnings between £12,571 to £50,270

- The rate was already due to be cut in 2024, but this was brought forward

What has changed:

- The basic rate of income tax will remain at 20%

- Cutting it has been put on hold “indefinitely”

Income tax – higher rate

What was announced:

- 45% rate of income tax for earnings over £150,000 abolished for England, Wales and Northern Ireland taxpayers

- One single higher rate of income tax of 40% from April next year

What has changed:

- The government had already U-turned on the cut to the higher rate, which is no longer going ahead

Corporation tax

What was announced:

- Cancel UK-wide rise in corporation tax which was due to increase from 19% to 25% in April 2023

What has changed:

- Ms Truss had already announced that UK corporation tax will go up from 19% to 25% in April 2023 after all

Energy bills

What was announced:

- The government said a typical household using both gas and electricity would pay £2,500 annually for two years. It announced this before the mini-budget

What has changed:

- The energy price guarantee now only covers this winter. I will be in place until April next year

- A Treasury-led review will look at what measures should be put in place after this date

IR35 rules

What was announced:

- The government had promised to change the rules on off-payroll working, known as IR35, so companies were no longer responsible for ensuring their contractors were paying the right amount of tax.

- It said the current system created “unnecessary complexity and cost” for businesses.

What has changed:

- This reform, which the government said would have cost £2bn a year, will no longer go ahead.

What else has been cancelled?

Other measures that have been cancelled include:

- VAT-free shopping for overseas visitors, which the government said would cost £2bn

- A freeze on alcohol duty, which would have cost £600m

- Cuts to the tax paid on shareholders’ dividends. An increase introduced in April will stay in place, saving about £1bn

What measures are staying?

Measures announced in the mini-budget that have not been cancelled include:

National Insurance

- Reverse recent rise in National Insurance (NI) from 6 November

- Workers and employers have paid an extra 1.25p in the pound since April

- New Health and Social Care Levy to pay for the NHS will not be introduced

Stamp duty

- Cut to stamp duty which is paid when people buy a property in England and Northern Ireland

- No stamp duty on first £250,000 and for first time buyers that rises to £425,000 – comes into operation today

- 200,000 more people will be taken out of paying stamp duty altogether, government claims

Benefits

- Rules around universal credit tightened, by reducing benefits if people don’t fulfil job search commitments

- Around 120,000 more people on Universal Credit to be asked to take steps to seek more work, or face having their benefits reduced

- Jobseekers over 50 to be given extra time with work coaches to help them return to job market