” There is going to be a massive injection of £150bn pumped into the economy by the Bank of England.

This is because of the ongoing effects of the resurgence of Covid-19. The UK is likely to move into a further slowdown due to the second lockdown. The UK is likely to avoid a second recession. Interest rates are already very low and have been for a long time.

Unemployment is expected to rise to 7.75% says the Bank of England.

Quantitative easing will be a way in which the Government pays for this.”

Nigel Holland

BBC

The Bank of England is to pump an extra £150bn into the economy as it warned the resurgence of Covid-19 would lead to a slower, bumpier recovery.

Tighter lockdown rules, including new restrictions in England, are expected to push the UK into another downturn.

While the economy is expected to avoid another recession, the Bank believes unemployment will rise sharply as government support schemes wind down.

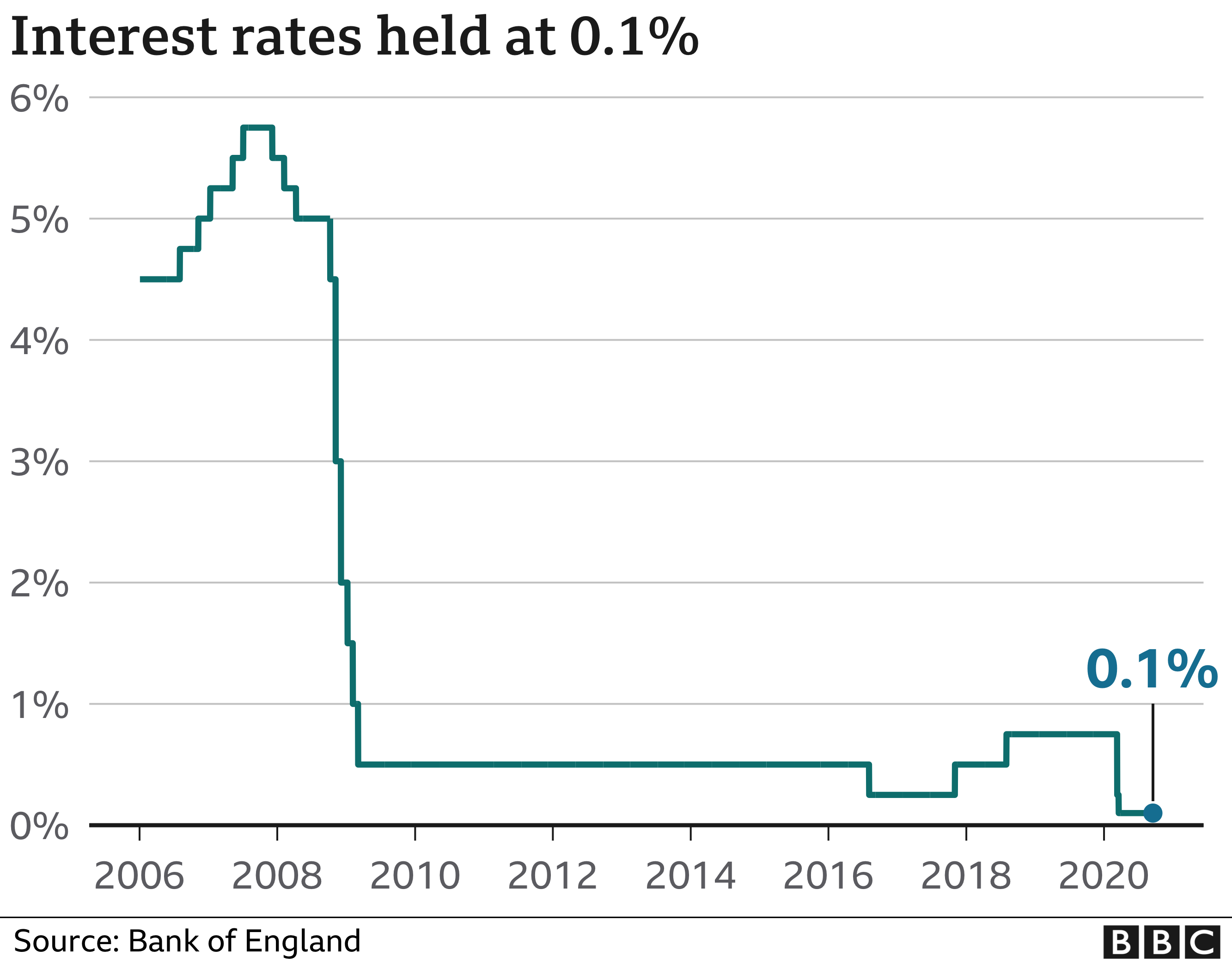

Policymakers also kept interest rates on hold at a record low of 0.1%.

The Bank expects the economy to shrink by 2% in the final three months of 2020, before bouncing back at the start of 2021, assuming current restrictions loosen.

It does not expect the UK economy to get back to its pre-virus size until the following year.

The Covid-19 pandemic triggered the sharpest economic contraction on record earlier this year as nationwide restrictions were brought in to try to contain the virus.

Shoppers helped the economy to bounce back over the summer, and the Bank said retail sales remained strong.

Some people had started their Christmas shopping early, while others were buying furniture and household goods to adapt to working from home.

However, it said the hospitality, leisure, and tourism sectors had “suffered from lockdown rules”.

Many diners had stopped going to restaurants after the end of the Eat Out to Help Out scheme. The Bank said more than a third of people still felt uncomfortable dining in.

Fresh restrictions across the UK are expected to drag on growth. The Bank expects the economy to shrink by 11% in 2020.

Unemployment to rise

Thousands of people have already lost their jobs amid the pandemic, despite various support packages, including an extended furlough scheme.

Redundancies have climbed to their highest level since 2009 in recent months.

The Bank expects unemployment to peak at 7.75% in the middle of next year, from 4.5% currently. This would be the highest rate since 2013.

This represents a deeper downturn, and slower recovery than predicted in August.

Chancellor Rishi Sunak is expected to announce fresh measures to support the economy on Thursday.

How does the Bank inject money into the economy?

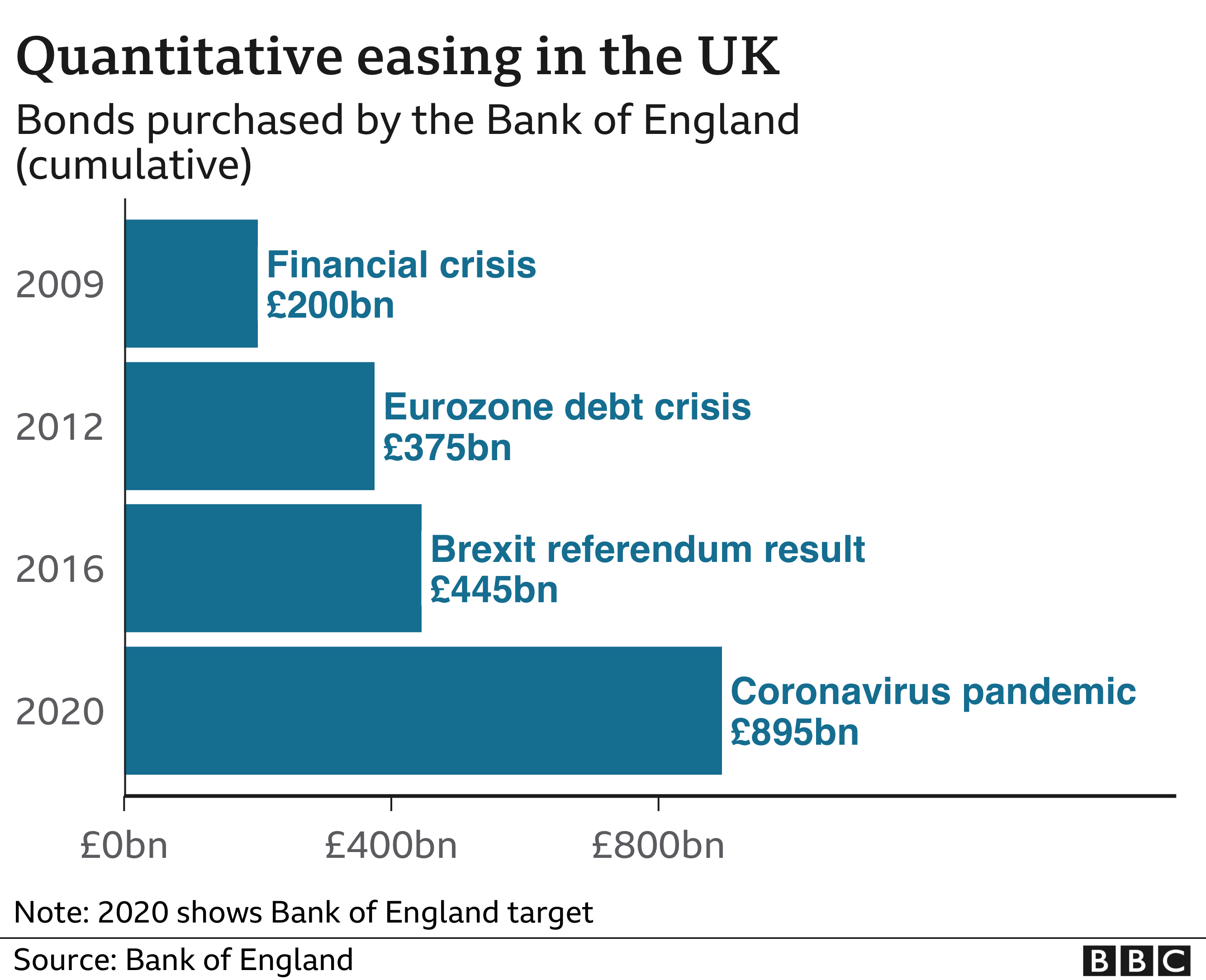

The Bank of England is in charge of the UK’s money supply – how much money is in circulation in the economy.

That means it can create new money electronically and the Bank spends most of this money buying government bonds through a process known as quantitative easing (QE).

QE is sometimes described as “printing money” but in fact no new physical bank notes are created.

Government bonds are a type of investment where you lend money to the government. In return, it promises to pay back a certain sum of money in the future, as well as interest in the meantime.

Buying billions of pounds’ worth of bonds pushes the price up: when demand for anything increases, the price usually goes up too.

Uncertain outlook

The Bank’s Monetary Policy Committee (MPC) that sets interest rates said its forecast reflected “heightened health concerns and uncertainty about the outlook”.

Its nine members voted unanimously to increase its stockpile of asset purchases, known as quantitative easing (QE), and signalled they were ready to unleash more stimulus if the recovery falters.

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said the Bank’s economic forecasts looked optimistic.

“The MPC’s forecasts have been updated for the new lockdown plans, but assume that the Covid hit to the economy gradually dissipates and that there is an immediate move to a free trade agreement with the EU in January; the risks to the outlook are skewed to the downside,” he said.

The Bank is currently exploring if it can reduce interest rates below the current level of 0.1%.

It wrote to lenders in October to ask them how they would cope with negative rates. Commercial banks have until 12 November to respond.

Karen Ward, chief markets strategist at JP Morgan, said pushing interest rates into negative territory was the “direction of travel” for many central banks.

However, she expects High Street banks to shield savers from being charged.

“It tends to be large corporates that really face those negative interest rates, but this really is about just exercising any tools they still have available, because of course with interest rates already near zero they’re getting more limited in what they can do,” she said.